Ten years ago, DCM Services conducted an informal survey of more than 100 health systems and other providers in an effort to understand current practices in the management of decedent accounts. At that time, almost 85% of survey respondents indicated that they did not search for probate estates, nor did they file claims. Survey respondents also acknowledged that they knew there was opportunity to enhance compliance and gain substantial revenue by creating an effective estate strategy but noted that they lacked the expertise and resources.

DCM Services enhances DCMS ServiceLink™ with Chat Functionality and Quick Pay feature

DCM Services, LLC (DCMS) the industry leader in estate and specialty account recovery solutions, has launched a new Quick Pay feature within DCMS ServiceLink™. We are also pleased to announce the official launch of chat functionality within DCMS ServiceLink. Clients who are eligible will have the option to allow online chat between their consumers and DCMS account representatives.

The estate recovery secret ingredient for auto portfolios

Written by Chris Stanley, Director of Business Development

When I go out to eat at a restaurant, often I’m there because of how the restaurant prepares food in its own way, what some may call the “secret sauce.” For example, the special sauce at a fried chicken joint. The proprietary ingredient takes ordinary fried chicken to uniquely delicious fowl. It may come as a surprise to know that the secret ingredient in an effective auto estate recoveries strategy is not optimization, but education.

Preparing your recovery process

When examining an estate recovery strategy for auto portfolios, there are many processes that align across DCM Services (DCMS) auto, credit card, banking, credit union, and telecom clients. We know that locating and filing on every probate estate is the most compliant and survivor-centric method to recovering on estate accounts and is the cornerstone of DCMS’ recovery strategy for all clients. It is a court-driven process with expected outcomes for the creditor, vendor, and estate. Through 20-plus years of working with the nation’s top auto lenders, we have learned that probate estates can liquidate up to seven times higher than non-probated estate accounts in the auto vertical. In addition to the compliance and survivor-centric benefits, this process provides the best return for our clients.

DCMS has also found value in scoring inventory to ensure our work efforts are devoted to the accounts with the greatest likelihood to pay. This does not mean that additional inventory is ignored; it simply means that work efforts are prioritized to accounts with a higher propensity to pay, subsequently minimizing complaints by not overworking inventory. It truly is a work smarter, not harder strategy. While effective estate location and scoring models are important, the differentiating factor is neither of these.

The secret ingredient? Education.

It may come as a surprise to know that education is the most important aspect of an effective recovery strategy for auto accounts, especially deficiency balance accounts. Auto accounts contain more complexity than a credit card or telecom account. In order to understand this, it is critical to remember that approximately 30% of all probate estates will be managed by a Personal Representative and not an attorney. Nearly all non-probate estate accounts will be managed by a family member.

These individuals are most likely going through the probate process for the very first time. Understandably, they are typically unfamiliar with the intricacies of the estate lifecycle, terminology, legal implications, and the flood of information as part of handling the decedent’s affairs. Because of the additional steps necessary to handle secured accounts internally at our client, this adds additional processes (repossession, voluntary surrender, assumption, etc.) to the estate recovery timeline.

As part of DCM Services’ partnership with many top auto lenders, educating personal representatives and individuals handling the decedent affairs is critical to minimizing complaints and maximizing recoveries. While DCMS does not provide legal advice, our Operations Teams and Account Representatives ensure each person we work with understands the next steps and possible situations that may arise in the future, while providing context for what has happened in the past. This can range from DCM Services’ intention to file a claim should a probate estate open or explaining how our client arrived at the deficiency balance that remains on an account.

Join 1,500 industry professionals in following DCM Services on LinkedIn →

Education is also critical at the partnership level. One of the most common questions DCMS receives from the family or personal representative is not understanding how the account came to our office. This can happen on first contact, when the personal representative receives a letter pertaining to the account, or when DCM Services files a claim against the probate estate. Often times, they believe that because the secured collateral was returned to the lender, no balance remains and therefore, any additional steps that occur may come as a surprise. Many of DCM Services’ partners work hard to ensure the estate account lifecycle is communicated at the point of notification but it takes time for an account to move from the point of notification through internal processes and ultimately to DCM Services.

DCM Services’ highest priority is to provide our clients with a productive stream of estate recovery liquidations while ensuring a positive consumer experience. Outside of DCMS strategies and the hard work of our Operations team, this is accomplished through transparent communication and setting expectations for the process. It starts with our clients at the point of notification and ends with DCMS up to the point of resolution. The importance of education and communication of the probate processes cannot be understated.

Ready to make education a cornerstone of your recovery strategy? Schedule a 30-minute meeting to discuss the unique obstacles and opportunities of your current processes here →

PSCU’s TriVerity™ (CU Recovery) Announces Partnership with DCM Services

TriVerity™ (formerly CU Recovery), a PSCU company, announced it has partnered with DCM Services, LLC (“DCMS”), the industry leader in data and contact management solutions for the estate and specialty receivables recovery market. The partnership will benefit credit unions across the nation as the two organizations combine their expertise in the accounts receivable management (ARM) industry.

Interview with a Probate Attorney

By Matt Rehnelt, Business Development Manager

In the probate and estate recoveries industries there are two distinct perspectives: that of the estate and that of the creditor. DCM Services has been well-versed in handling matters from the creditor’s perspective for more than 20 years, working with 25 of the top 100 auto lenders in the U.S. Throughout my career, I have found it extremely beneficial to thoroughly understand each point of view to achieve the best possible outcome.

Recently, I spoke with a local probate attorney to learn about the most common questions they hear from their clients on a regular basis, as well as how they would advise the estate to proceed. The answers I received were enlightening.

Q: If a family member recently passed away and has a car loan in their name only, can you continue to make the car payment until the vehicle is paid off?

A: The lender is probably within their rights to force a change. However, there are other issues – for example, you may need to register the vehicle and you may only be able to do that if you pay off the loan.

Insurance may also be a problem. If the vehicle is insured in the decedent's name, then the insurance company will balk at paying if there is a future claim. If and when the loan is repaid, the lender will issue a release to the decedent. How this release would apply to the new owner is also questionable.

If you can get around these items, then the main concern may be getting the vehicle retitled. If there is no probate estate and if the person in question is an heir, there is a simplified process. However, if probate is necessary, the auto loan will then need to be considered an asset of the estate before being transferred.

Q: So, what happens to that loan once it is considered an asset of the probated estate?

A: In most cases, a creditor is within their rights to file a claim against the probate estate. This will allow the remaining balance owed to be recognized against any of the assets in the probate estate. Before the probate estate can be formally closed, all creditors that had filed claims would need to be addressed in the correct order.

Q: That brings up a good point. Knowing whether the estate is going to have enough funds to resolve the debt is a huge time saver, because that ultimately lets a creditor know if they are getting a settlement in full, pro-rata, or nothing at all. What is your process of notifying creditors when there are not enough funds to resolve claims?

A: Well, most attorneys I know have a pretty similar process. The Personal Representative must look at the claims that have been filed and determine which debts get paid first. Under many state laws, there is a specific order in which the debts must be paid:

Priority of claims

Costs and expenses of administering the estate, including attorney’s fees.

Reasonable funeral expenses will be paid.

Any debt that has preference under Federal law, including for example, Federal taxes.

Expenses for medical costs or hospital stays for the decedent’s final illness and/or secure debts (i.e., boat loans, auto loans, etc.).

Expenses for medical costs or hospital expenses incurred during the year before death.

Any debts under federal law, such as state taxes, and last, any other unsecured debt. The personal representative pays the debts in this order, not in the order in which the claims are received.

Once the assets of the estate run out, then the debts that are further down the priority list will simply not be paid or will need to be pro-rated based on remaining funds.

In the event the estate is insolvent, or unable to pay creditors, we will typically work with the Personal Representative to prepare an itemized inventory of all of the debts and assets. Ultimately, this provides the creditor with some form of documentation showing the estate truly does not have the funds to resolve their claim. Typically, this documentation is not sent to creditors unless requested because of the extra charges brought upon an estate that is already lacking funds.

Q: Interesting. My last question is a bit of a tough one. Do attorneys ever “bend the truth” to make it look like the estate does not have funds to pay claims?

A: I do not want to speak on behalf of all legal counsel in the United States, but it’s not out of the realm of possibility. I think that ultimately, a Personal Representative retains an attorney to represent the estate for a couple reasons; the first is due to the nature of probate, it can be a time intensive process. Personal Representatives negotiating on their own means less time with their family and more than likely taking time off of work.

The second reason is that attorneys can typically save a good portion of funds for the estate by either negotiating debts down, accepting settlements, and/or taking advantage of other state statutes that legally allow heirs to receive certain funds prior to creditors, such as homestead laws or administration fees.

Ultimately, probate proceedings can take up to a year or two, the assets are typically "frozen" until the courts decide on the distribution of the property. Probate can easily cost between 3% and 7% or more of the total estate value. If the estate does have liquid assets available, it sometimes in the best interest of all parties to resolve the estate in a timely manner.

Q: I appreciate you talking with me today and agreeing to be part of my new series “Interviews with a Probate Attorney”. Is there anything else you would like to add?

A: My biggest suggestion for individuals who are looking to retain an attorney to assist in probate, setting up a trust, transfer on death [deeds or accounts], or any other matter, is to choose someone that they feel comfortable with and share the same values and ethics. Having a certain level of trust, creates peace of mind and makes the entire process that much easier.

The contents of this article are not intended as legal advice. This article is intended only for general informational purposes. If you have any questions, please consult with your legal counsel.

About the author

Spending a majority of his career working within the financial services and healthcare industries, Matt has worked with DCMS since 2010. Matt works hand-in-hand with organizations to create and enhance their estate recovery process. Matt graduated from Metropolitan State University with his Bachelors in Business

Administration.

Podcast - Examining effective specialty recovery processes in auto finance

DCM Services Launches Major Upgrade to Probate Finder OnDemand® with New Functionality

MINNEAPOLIS – DCM Services, LLC (“DCMS”) and its sister company, Forte, LLC, the industry leaders in data and contact management solutions for the estate and specialty receivables recovery market, celebrate the launch of a major upgrade to the Probate Finder OnDemand application.

Probate Finder OnDemand provides client access to Forte’s patented Probate Finder® technology and automates robust and time-consuming probate location, matching, and claim presentation processes. All of this happens within a secure interface, simplifying the user experience and automating an otherwise manual process. Launched in 2010, its Software-as-a-Service (SaaS) model has grown to serve over 200 organizations spanning several end-markets including financial services, auto, retail, credit unions, government, and healthcare.

DCMS CEO Tim Bauer, reflected on the utility of the product, “Probate Finder OnDemand is the only SaaS tool of its kind providing our clients with a simple and efficient way to identify probated estates. It then goes further to allow our clients a seamless opportunity to file a claim on the probated estate. This new redesign provides more tools for our clients and makes it easier to use.”

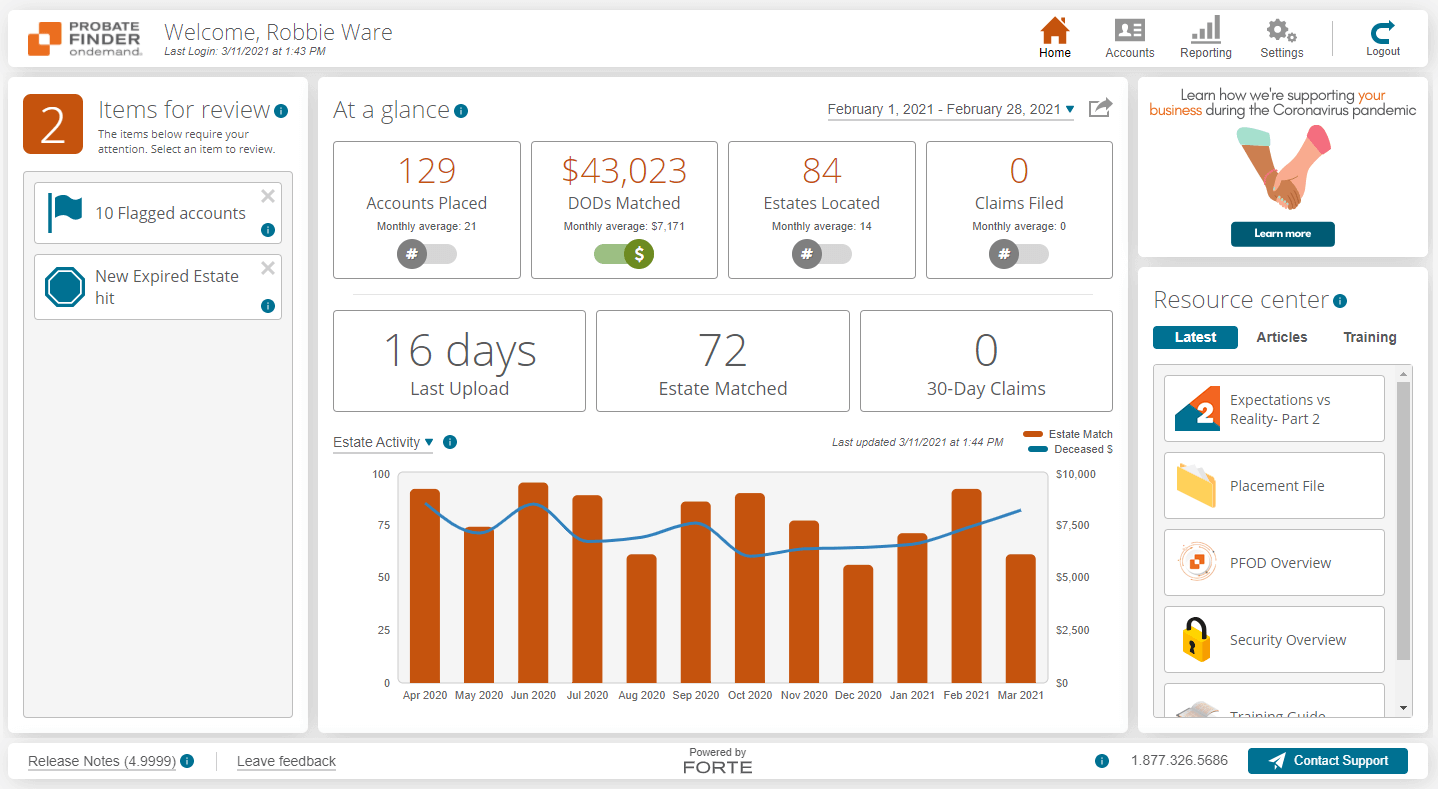

Since its inception, the application has been continuously developed based on direct client feedback and user needs. The upgraded user experience offers impactful new features such as a notification system, insightful dashboard reporting tools, and an educational resource center. These features put relevant and actionable information in focus for Probate Finder OnDemand’s valued clients.

The newly enhanced Home dashboard puts your team in control with the perfect balance of insight and action.

Chief Technology Officer and creator of Probate Finder OnDemand, Dereck Eastman was ecstatic, “This new version of our application highlights DCMS’ perpetual focus on improving the products and services we deliver to our customers. The new design brings a fresh look and feel to the application while maintaining the core workflow of the product which continues to make it the easiest way for creditors to locate probated estates and present claims across the country.”

Sr. Product Manager and project owner Sara Brown said, “We pride ourselves in the innovative vision of Probate Finder OnDemand, and this new upgrade is the next step in the product evolution. The revamped dashboard empowers our customers with critical information and educational resources to help drive their success.”

Learn more about how Probate Finder OnDemand revolutionizes the probate recoveries process here →

--

This press release was also featured on insideARM, AccountsRecovery.net, and Probatefinder.com.

About DCM Services

Minneapolis-based DCM Services is the industry leader in estate and specialty account resolution services, maximizing the value of client portfolios across financial services, healthcare, auto, retail, telecom, credit union, government and utilities industries through innovation and performance. Its recovery solutions offer a full range of services from proprietary web-based solutions to full outsourcing, maintaining an unmatched spectrum of innovative solutions that increase recoveries, protect brand value, and enhance survivor relationships – with respect and sensitivity. For more information on all DCM Services’ offerings, please visit www.dcmservices.com.

Join 1,400+ industry professionals in following DCM Services on LinkedIn →

Putting the “Pro” in Probate

How Probate Finder OnDemand® revolutionizes the probate process.

By Jason Hamey, Probate Finder Team Lead

The final version of the original U.S. Uniform Probate Code (UPC) was enacted in 1969, when a gallon of gas cost $0.35 and you could buy a new house for the price of your current car. While probate law has been revised over time, the vast diversity of the 3,415 state probate courts has left an entangled web of various court rules and restrictions, some of which date back to the original UPC.

Manually attempting to recover on probated estates often ends up costing more money than any revenue that may follow. Probate Finder OnDemand removes manual probate work for your team and allows you to maintain process ownership, all while controlling costs by locating open estates and filing claims on those which best fit your portfolio.

To overcome this vast challenge to maintain rules, we have dedicated teams of specialists who manage those changes for Probate Finder OnDemand behind the scenes.

“Behind the scenes” teams of Probate Finder OnDemand

Probate Finder OnDemand operations consist of five unique teams who work in tandem to facilitate the probate process end-to-end. Here’s a brief overview of each team:

Probate Finder Data Team: Captures probate estate records filed throughout the nation and adds this data to the nationwide Probate Finder® database. They also work with the probate courts to create reliable processes and ensure accurate data is sourced. Nearly 45,000 probate records are added monthly.

Probate Finder Claims Team: Manages claim filing requirements for all probate courts and ensures compliance with highly regimented claim filing procedures.

Quality Assurance Team: Our Quality Assurance team conducts regular quality control audits to ensure claim processing is compliant with the applicable processes and procedures.

Development Team: In-house development team who builds and maintains our state-of-the-art systems. This team performs ongoing review and application updates that focus on accuracy, quality, compliance, transparency, and user experience.

Probate Finder OnDemand Customer Care Team: Dedicated team to support partnership success by providing system training, addressing probate related questions, and collaborating to fine tune strategies.

Innovative technology and user experience

The controls and considerations provided by each team are built within our Probate Finder technology and are nothing short of astounding. As one of our clients somewhat jokingly put it, “This is better than the system in our offices. Is it for sale?” We locate an open probated estate for one of your accounts, you are notified of the match and it is up to you to decide if you want to file a claim. If you choose to proceed, the account data is validated by someone at your office to ensure accurate information.

After providing your claim approval, the Probate Finder technology will generate a claim for your account systemically. This means that our technology recognizes where the claim is going, which claim form is required, the rules and requirements of that jurisdiction (such as the color of paper and number of copies required), and creates the claim. Once the claim package is printed, signed, and notarized, we create a PDF image and upload it into the Probate Finder OnDemand application. This ensures that your team will always have access to a copy of the signed document.

Remove manual probate work for your team and maintain process ownership, all while controlling costs by filing claims on estates which best fit their portfolios.

Finally, the claim is mailed or electronically filed with the appropriate parties. Each step of this process has controls to ensure data and process accuracy. If a data element changes at any time during processing – whether you update information in the Probate Finder OnDemand application or our data record in Probate Finder receives updated information – the claim will be voided automatically, and the entire process begins anew.

The Probate Finder OnDemand Customer Care Team helps your team employ a robust post-claim process as well. You may have filed a claim and would like to amend the filing, we can do that for you as well. If a claim was returned by the court due to a process change, we will thoroughly investigate the change and a new claim will be presented. Or maybe your claim simply was not received, we will review the account and get a new claim filed. All of this is included in our solution and done through the Probate Finder OnDemand application by a click of a button.

Want to see Probate Finder OnDemand in action? Schedule a demo with a probate specialist.

Learn more about the cutting-edge features of Probate Finder OnDemand that you won’t find in this article.

DCM Services names Tiffany Jansen Senior Vice President, Business Development.

Minneapolis, MN — October 6th, 2020 — DCM Services, LLC (DCMS) the industry leader in estate and specialty account recovery solutions, announced the promotion of Tiffany Jansen to Senior Vice President, Business Development.

Jansen, who most recently served as Vice President of Executive Account Management, will now also oversee sales and marketing strategies for DCMS.

“Tiffany has been an invaluable member of the DCMS team over the last 17 years, said Tim Bauer, DCMS Chief Executive Officer. “Her involvement in our ongoing growth and company initiatives has contributed to our overall success. We are excited to continue our growth into additional markets under Tiffany’s leadership.”

Jansen joined the organization in 2003 and has held various roles within both Operations and Business Development. She holds a Bachelor of Arts degree from the University of Minnesota Twin Cities.

--

About DCM Services

Minneapolis-based DCM Services, is the industry leader in estate and specialty account resolution services, maximizing the value of client portfolios across financial services, healthcare, retail, utility, and telecom industries through innovation and performance. Its recovery solutions offer a full range of services from proprietary web-based solutions to full outsourcing, maintaining an unmatched spectrum of innovative solutions that increase recoveries, protect brand value, and enhance survivor relationships – with respect and sensitivity. For more information on all DCM Services’ offerings, visit www.dcmservices.com.

A New Chapter in Bankruptcy: How the Pandemic is Influencing Consumer and Commercial Bankruptcy Filings

Most would agree that the COVID-19 Pandemic has affected all aspects of life and business this year. The impact of the pandemic on consumer bankruptcy case filings has been surprising to say the least. After the initial spread of the virus triggered a rash of stay-at-home orders, consumer filings in April dropped suddenly and sharply. In April, new consumer case filings dropped 39% from the prior month. May and June continued to see fewer consumer case filings as well, both months new consumer case filings were down more than 30% from comparable 2019 rates.